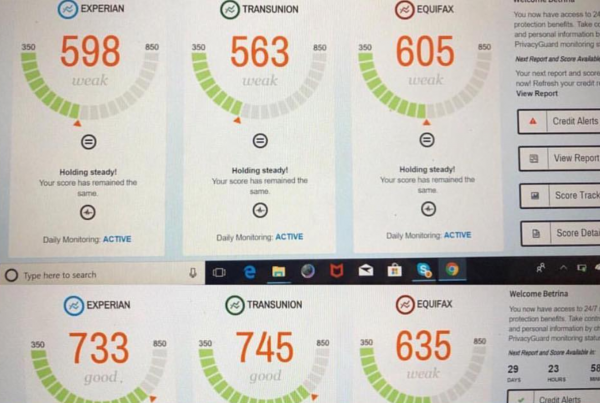

Securing A LOAN While Rebuilding Your CREDIT

I wanted to address a topic that has helped my clients crush it with securing a LOAN while rebuilding their CREDIT - so pay close attention… Does anyone know what a 'Thin Credit File' means? You…